尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

American consumers have become used to buying T-shirts, plushies and other knick-knacks from the likes of Temu and Shein at rock-bottom prices. Whether they knew it or not, their bargains were partly the result of an old tax loophole that is now being taken away. Fortunately for them, the future of online binge-buying remains cheap, if a little less cheerful.

美国消费者已经习惯于从像Temu和希音(Shein)这样的商家以极低的价格购买T恤、毛绒玩具和其他小饰品。不管他们是否知道,这些便宜货部分是由于一个旧的税收漏洞,而这个漏洞现在正在被取消。幸运的是,尽管未来的在线疯狂购物可能会稍微不那么令人愉快,但价格仍然便宜。

President Donald Trump’s crackdown on the “de minimis rule” — which allows overseas packages valued at $800 or less to enter the US tax-free as long as they are sent directly to individuals — means that a $10 mini skirt, dinner-plate set or inflatable hamburger outfit will now be subject to normal import taxes as well as the extra 10 per cent tariff that Trump has levied on all imports from China.

美国总统唐纳德•特朗普(Donald Trump)对“微量豁免规则”(de minimis rule)的打击——该规则允许价值800美元或以下的海外包裹直接寄给个人时免税进入美国——意味着一条10美元的迷你裙、餐具套装或充气汉堡服装现在将需要缴纳正常的进口税,以及特朗普对所有来自中国的进口商品征收的额外10%的关税。

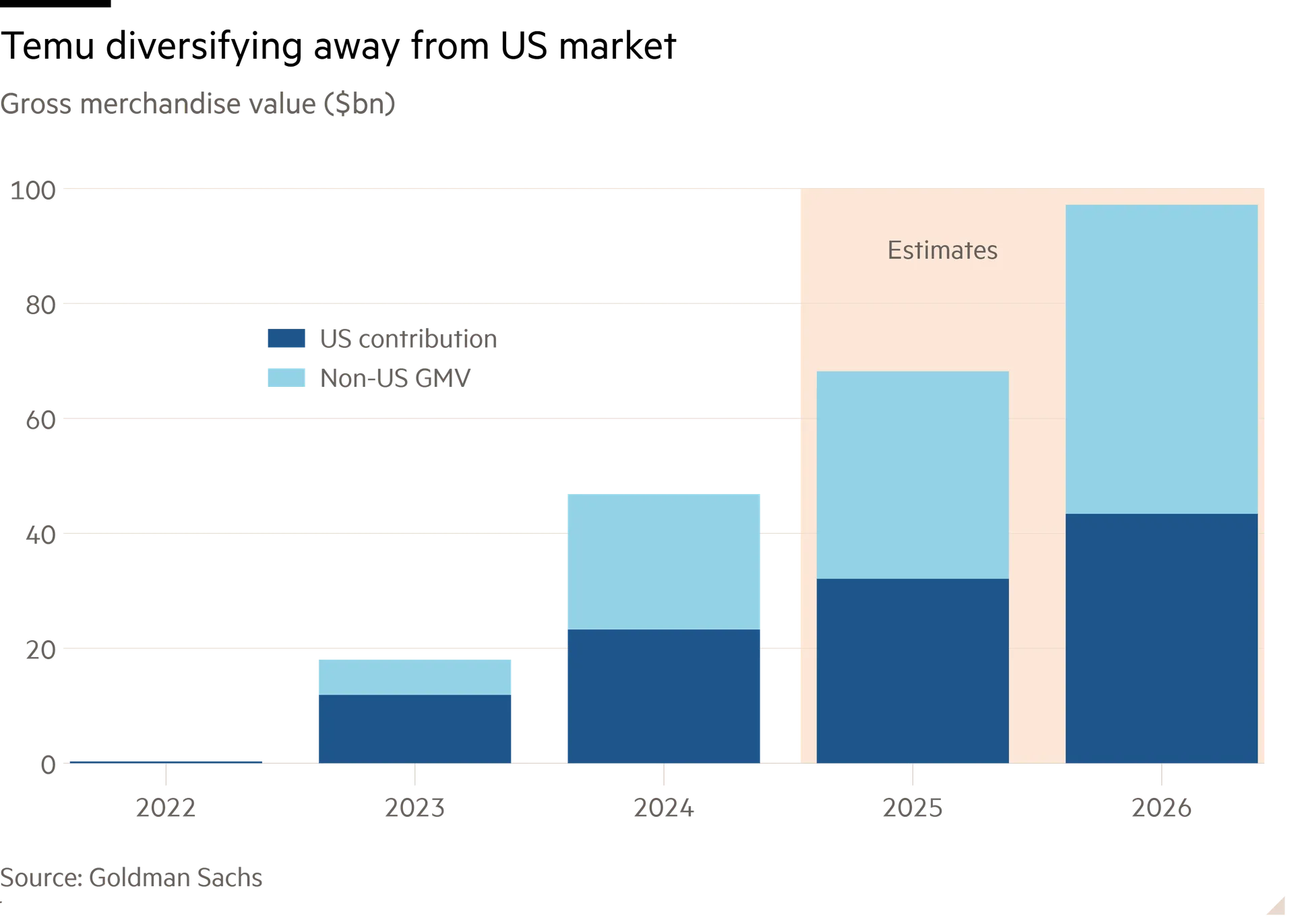

Temu, in particular, has been preparing for this day. The online store, part of Chinese internet group PDD, has been growing strongly. Bernstein Research reckons its global gross merchandise value — the total of all goods sold — jumped from $17bn in 2023 to more than $50bn last year. The figure could double to $97bn by 2026, according to Goldman Sachs.

特别是Temu,一直在为这一天做准备。作为中国互联网集团拼多多(PDD)的一部分,这家在线商店一直在强劲增长。伯恩斯坦研究(Bernstein Research)估计,其全球商品总值(GMV)——即所有商品的总销售额——从2023年的170亿美元跃升至去年的500多亿美元。根据高盛(Goldman Sachs)的数据,这一数字到2026年可能会翻倍至970亿美元。

It has also diversified geographically — limiting the impact of tax loophole closures. The US accounts for less than half of Temu’s global GMV, compared with 100 per cent three years ago, when the app first launched.

它在地域上也实现了多元化,从而减小了税收漏洞关闭的影响。美国在Temu全球GMV中的占比不到一半,而三年前该应用首次推出时,这一比例为100%。

Meanwhile, Temu has moved away from its “direct from China factory floors” consignment business model. It has recruited vendors who already have goods in US and European warehouses and simply use Temu as a shop window. Goods sold under this semi-consignment model, in which vendors handle their own shipping and delivery logistics, were already imported in bulk, so didn’t benefit from the de-minimis perk. Temu competes with Amazon for their business, with lower and fewer fees.

与此同时,Temu 已经摒弃了“直接从中国工厂发货”的寄售业务模式。它招募了那些已经在美国和欧洲仓库中有货物的供应商,仅仅将 Temu 作为一个展示窗口。在这种半寄售模式下,供应商自行处理运输和交付物流,商品已经以批量进口,因此无法享受免税优惠。Temu 以更低和更少的费用与亚马逊(Amazon)竞争这些业务。

This strategic shift leaves Temu less reliant on China-based merchants selling small lots of merchandise overseas. Indeed, semi consignment vendors now account for about a quarter of Temu’s US GMV, says Goldman. The adoption of this model in other countries means only 20 per cent of Temu’s global GMV is exposed to potential changes in the de minimis provision, added Bernstein.

这一战略转变使得Temu不再过于依赖中国商家向海外销售小批量商品。实际上,高盛表示,半寄售供应商现在占Temu美国GMV的约四分之一。伯恩斯坦研究补充道,在其他国家采用这一模式意味着Temu全球GMV中只有20%可能受到微量豁免规则变化的影响。

Like Shein, which is unlisted but considering a London initial public offering, Temu doesn’t need a tax quirk to be a big threat to bricks-and-mortar retailers. Trump’s trade war is expected to drive prices for everything from avocados to energy higher — which means the “trading down” trend could get a new fillip. De minimis might describe these retailers’ prices, but the businesses themselves are anything but.

像希音一样,Temu尚未上市,但正在考虑在伦敦进行首次公开募股。Temu不需要税收漏洞就能对实体零售商构成巨大威胁。特朗普的贸易战预计将推动从牛油果到能源的所有商品价格上涨——这意味着“降级消费”趋势可能会得到新的推动。这些零售商的价格可能可以用“微量”来形容,但其业务本身却绝非如此。